Since the onset of the COVID-19 pandemic, there has been a dramatic shift in the way we do business. Traditional brick and mortar businesses as well as new startups are quickly pivoting to online platforms in order to connect and service their customers.

The BC government recognizes this shift as well with the implementation of The Launch Online Grant program, put in place to support online expansion efforts of BC businesses.

To business owners making this transition, they need to be aware and educated on the legal implications of operating an online business.

This guide covers important legal considerations to help online businesses comply with the law to mitigate as much risk as possible.

Determining your Business Structure

If you have a new startup venture, you will need to determine the right business structure for your venture. The three most common types of business include: sole proprietorship, partnership, or corporation.

Most new businesses will benefit from incorporation as it helps limit your personal liability by protecting your personal assets, such as your house, car, personal bank account. Furthermore, incorporating your business often results in lower taxes overall, due to the much lower taxes paid by Canadian-controlled private corporations for the first $500,000.00 of income.

Please note: we do not provide tax advice and encourage you to discuss tax-related matters with your accountant or tax advisor.

However, since every business situation is unique, it’s beneficial to seek legal counsel to assist you in selecting, and setting up, the correct business structure.

Obtaining Licenses and Permits

Investigate whether your business activities, industry, and location requires licenses or permits in order to operate legally.

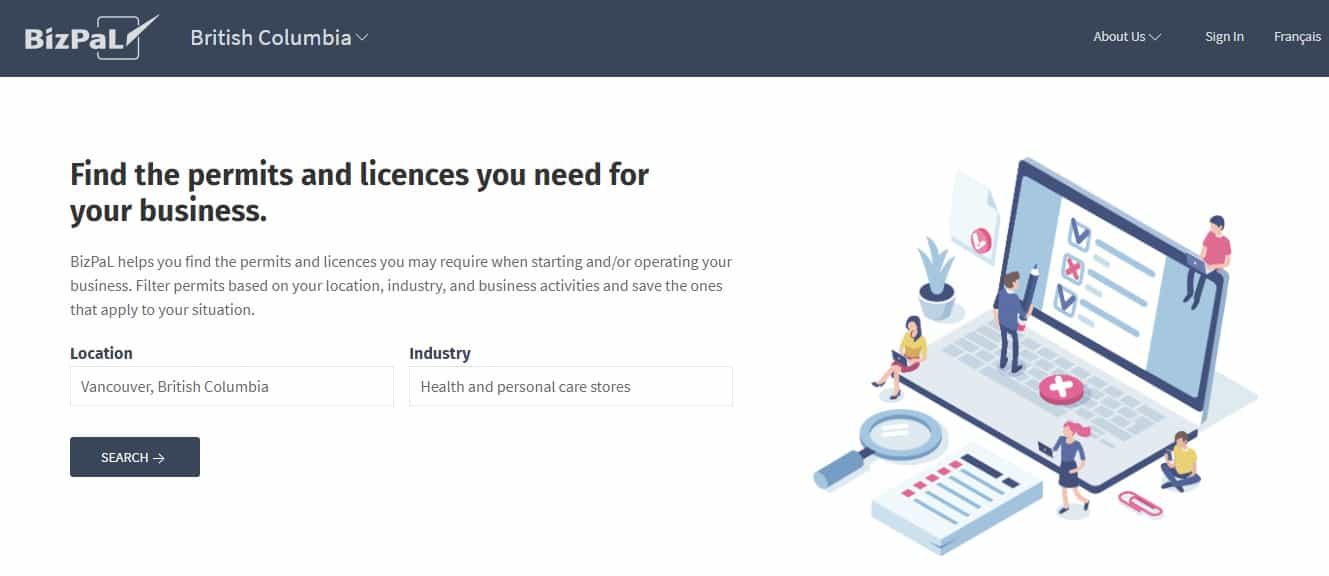

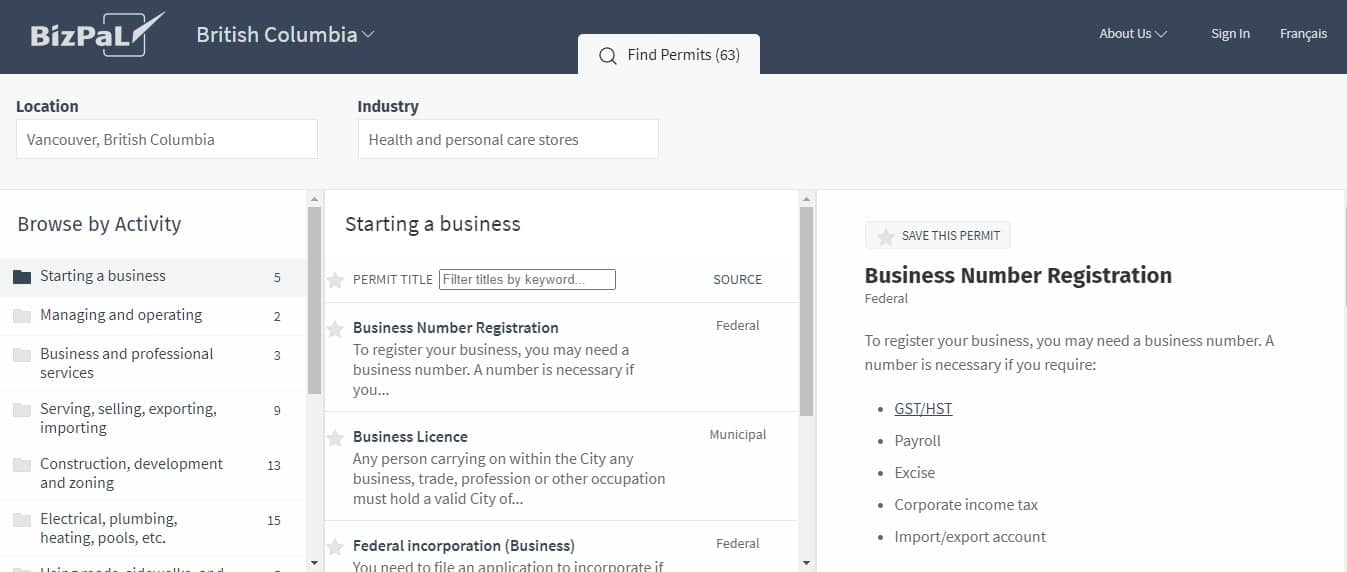

A helpful tool to identify what types of licenses, permits, or registrations are required on the municipal, provincial, and federal level can be located on BizPal.

Example: You’re an entrepreneur in Vancouver looking to sell cosmetic products online.

First, type in the location and relevant industry. For “cosmetic products”, Health and Personal Care Stores will appear. Click search.

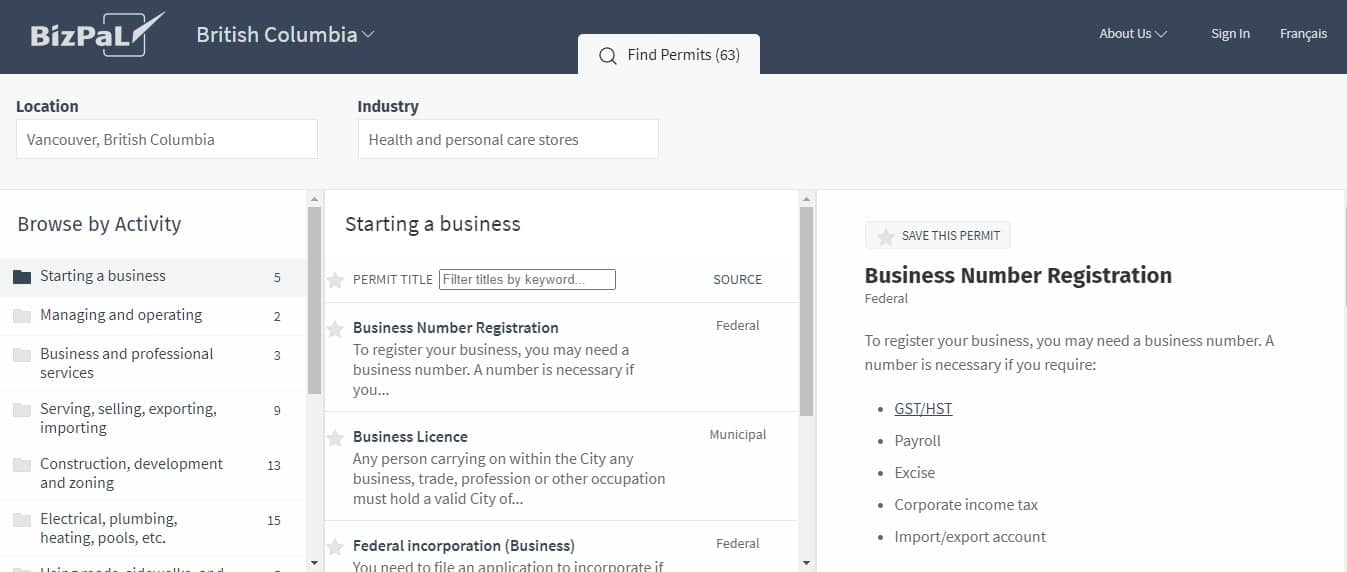

The search yielded 63 potential results separated by various categories. Go through the list to determine which ones may apply to your business.

The far right column will display important information for every permit. This includes:

- What the permit or license is for

- Any prerequisites required prior to applying for the permit

- Cost, renewal period, waiting period, and inspection requirements

- Online and paper application forms

- Who to contact for more information

Collecting Taxes

Every province and country will have different tax regulations, so it is critical that you know what taxes apply to the products or services that you are offering. Generally, existing tax laws will apply equally in both online and offline environments.

You should also carefully consider the tax-implications of selling to customers in different jurisdictions. If you are selling within Canada, every province or territory has its own sales tax amounts.

Province | Type | PST | GST | HST | Total Tax Rate |

|---|---|---|---|---|---|

Alberta | GST | 5% | 5% | ||

British Columbia | GST + PST | 7% | 5% | 12% | |

Manitoba | GST + PST | 7% | 5% | 12% | |

New Brunswick | HST | 15% | 15% | ||

Newfoundland and Labrador | HST | 15% | 15% | ||

Northwest Territories | GST | 5% | 5% | ||

Nova Scotia | HST | 15% | 15% | ||

Nunavut | GST | 5% | 5% | ||

Ontario | HST | 13% | 13% | ||

Prince Edward Island | HST | 15% | 15% | ||

Quebec | GST + *QST | *9.975% | 5% | 14.975% | |

Saskatchewan | GST + PST | 6% | 5% | 11% | |

Yukon | GST | 5% | 5% |

If you are selling to customers in other countries, your legal obligations regarding those countries’ tax laws will likely vary as well.

For example, starting April 1, 2021, the following products and services are no longer PST exempt in BC:

- Soda beverages and sugary drinks

- Digital software and telecommunication services will be required to collect the PST on sales to BC customers if they have revenue in the province of more than $10,000

- All Canadian sellers of vapour products will be required to register to collect the sales tax on all online or mail-order sales to BC customers

If you are selling to customers to other countries, your legal obligations to those countries’ tax laws will vary as well.

Seek professional tax advice from an accountant to determine which taxes apply to your goods and services. This ensures that all your business transactions are compliant with the law.

Protecting Intellectual Property

A study conducted by Compumark indicated that 85% of brands experienced trademark infringement in the past year and steadily on the rise.

With the influx of new online merchants, both established and emerging brands need to be extremely vigilant in protecting their intellectual property assets.

There are three types of intellectual property assets that are most commonly protected:

- Trademarks - Business names, logos, slogans/taglines, and sub-brands

- Copyrights - All original artistic works such as books, music, paintings, drawings, maps, photographs, designs, computer code, and other creative works

- Patents - Inventions of newly developed technologies as well as improvements on products or processes

The process for legal registration will vary depending on which elements you wish to protect. An experienced IP lawyer can help you assess your brand portfolio to determine the best course of action to protect your intellectual property rights.

Intellectual Property Due Diligence

On the flip side, perform your due diligence to make sure you’re not infringing on another brand’s trademarks, copyrights, or patents with your products or services.

For instance:

- Domain names - Your domain name should not include the name of another company or product.

- Meta tags - Meta tags are snippets of text hidden in the source code that describes website content to search engines. The inclusion of another company’s trademarks into the meta tag is trademark infringement.

- Images - Confirm you have permission to use any images on your website if it is not your original work. Websites that offer stock images will require some form of attribution or copyright license.

- Weblinks - Carefully consider how links are used on your website. If the logo, trademark or descriptive text of the linked-to company is used, this may lead to trademark infringement

Website Development and Hosting Agreements

Below is a non-exhaustive list of matters to consider when entering into agreements with website developers and web hosts:

Website Development

A clear written agreement with the website developer will set out concrete objectives, expectations, timelines, and the overall scope of the project. This will help you avoid misunderstandings with the website developer and ensure both parties are 'on the same page' regarding the project.

The website developer agreement should clearly identify the following:

- website design, content, and functionality;

- project development timeline and updates;

- intellectual property rights;

- client obligations;

- web developer obligations;

- support and maintenance;

- payment terms;

- confidentiality and noncompete clauses; and

- other deliverables.

If you have never hired a 3rd party to develop a website before, it may be a good idea to have a lawyer review the agreement in detail to ensure your rights are protected.

Website Hosting

While web developers have the capability to offer web hosting services on their own servers, some may choose to contract a separate web hosting provider.

If you do choose a different hosting provider, does the website hosting agreement provide you with adequate rights and remedies regarding the performance of your website?

Some matters for you to consider:

- Service Dependability: What is guaranteed uptime of the website? Uptime is the time your website is working and accessible online. Are there guarantees to response time if problems arise?

- Support Coverage: Are the levels and type of management, monitoring, and migration services clearly specified? Does the agreement specify how often the website will be backed up?

- Scalability: Are you locked in a given plan? Are plans flexible should your hosting needs change?

- Security: Does the agreement specify what guarantees are provided if security is breached from a cyber-attack on your server?

- Renewal policy: Are renewals automatic? How far in advance are notifications for fee changes?

- Termination of Service: Does the agreement specify the steps and conditions for termination of service if you want to change providers?

Website Terms of Use

A website’s Terms of Use (also known as “Terms of Service” or “Terms and Conditions”) is an agreement that is a legally binding set of rules and guidelines that governs how users can interact with a website.

This agreement helps protect your site from potential abuse as well as minimizes your liability, particularly if your website engages in e-commerce.

The type of terms covered by this agreement will ultimately depend on the nature of your business.

Common Terms of Use clauses may include:

- Conditions of use

- Personal data collection

- Privacy disclaimers

- Payment and billing

- Product information

- Taxes

- Delivery terms

- Liability limitations

- Intellectual property

- Return and cancellation policies

- External/3rd party links

Privacy Policy

Under Canada’s privacy laws, businesses are required to be transparent with their privacy policies and procedures, as well as obtain consent from website users before they can collect, use, disclose or store their personal information.

Canada’s federal privacy legislation, The Personal Information Protection and Electronic Documents Act (PIPEDA) defines personal information as identifiable information that can be used to contact or identify you.

If the business’ data collection, use, or disclosure only occurs within British Columbia’s boundaries, the province follows its own private sector privacy-laws called the Personal Information Protection Act (PIPA), which is similar to PIPEDA.

As stated in the PIPA,

“The purpose of this Act is to govern the collection, use and disclosure of personal information by organizations in a manner that recognizes both the right of individuals to protect their personal information and the need of organizations to collect, use or disclose personal information for purposes that a reasonable person would consider appropriate in the circumstances.”

Personal data that a website collects from its users may include:

- First and last name

- Age

- Gender

- Marital status

- Birthday

- Email addresses

- Phone numbers

- Geographical location

- Payment information

- Tracking and cookies data (A cookie is a uniquely assigned data file that temporarily tracks and stores your preferences and settings on the website)

- Usage data (e.g. IP address, browser type, browser version, visited pages, visit timestamps and duration, unique device identifiers and other diagnostic data.

Your Privacy Policy documentation should be posted on a separate page on the business’s website.

Make sure you meet your obligations for protecting personal information when drafting your Privacy Policy to ensure that you abide by both federal and provincial privacy laws as applicable to your business.

Canada Federal Anti-Spam Legislation (CASL)

Email and text messaging has become an essential communication tool in today’s business environment.

However, any business that sends commercial electronic messages to its users must ensure that its communication procedures comply with Canada’s federal anti-spam legislation, CASL.

The CASL requires businesses to obtain implicit or explicit consent from users before sending them emails or texts with clear options to unsubscribe or opt-out. This is especially important for ecommerce businesses, which often rely on email marketing initiatives and social media messaging to engage and promote to customers.

Non-compliance with the anti-spam law can result in significant penalties so it’s imperative to mitigate that risk by developing a solid anti-spam policy with the assistance of experienced legal counsel.

Conclusion

Whether you’re a new startup or an established small business transitioning to ecommerce, it can be difficult to navigate all legal documentation and compliance issues as highlighted above.

Proper guidance from a knowledgeable business lawyer will help you to better prepare and protect your business (and yourself) before entering the online marketplace.

Please call us directly at (778) 565-4700 or simply fill out our contact form to schedule a free consultation to speak with one of our experienced business lawyers today.

The preceding content is for informational purposes only and does not constitute legal or professional advice. To obtain such advice, please contact our offices directly.

Last updated on March 9th, 2022 at 10:45 am