According to the Key Small Business Statistics report by industry Canada, small businesses with 1-4 employees have a 60.5% survival rate and 5-19 employees have a 66.4 % survival rate in the first 5 years of operation. For those that continue to operate, part of their success can be accredited to efficient tax-planning initiated through holding companies.

Holding companies can be an ideal business structure to help protect your business interests now and in the future.

In this post, we will explain what a holding company is and touch upon the primary benefits of forming this entity behind the operational structure of your business, which includes asset protection, capital gains exemptions, tax savings, and succession planning.

What is a holding company?

Simply put, a holding company is a parent corporation that owns assets of other companies, but do not actively participate in the daily business operations of a business.

It’s the operating company that produces and sells the goods and/or services instead of the holding company.

Example:

What type of assets can holding companies own?

A holding company can own a wide range of assets and the most frequently owned business assets may include:

- Shares of stock of other corporations

- Equity and hedge funds

- Interest earning investments

- Intellectual property (trademarks, patents, copyrights)

- Real estate properties, land

Why incorporate a holding company?

Through incorporation of a holding company, there are a variety of strategies that business owners can utilize to help limit liability risks, minimize taxes, and protect assets.

The following are 4 primary reasons to form a holding company:

1. Asset Protection from Creditors

By creating a holding company, excess earnings/monies from the operating company can be withdrawn to the holding company (usually in the form of tax-free dividends) to shelter against creditor claims.

The holding company will be able to use these dividends as an investment vehicle to generate assets safely out of the reach of creditors.

Also, if the operating company ever requires a loan to purchase assets, they can borrow the funds from the holding company to do so. This arrangement will allow the holding company priority claim of the debt on the assets over external creditors.

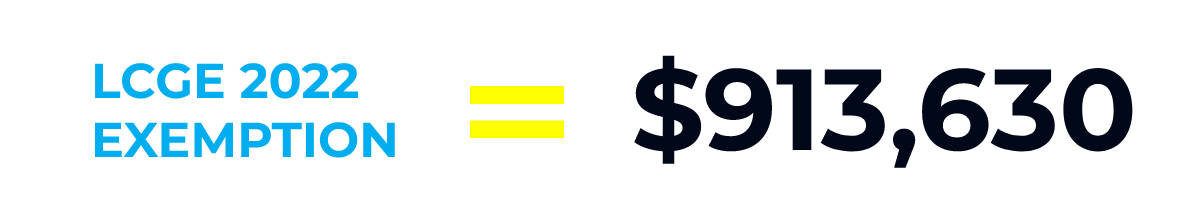

The lifetime capital gains exemption (LCGE) of $913,630 as of January 1, 2022 can be claimed to offset a capital gain on the sale of shares of a qualified small business corporation (QSBC).

This is a lifetime cumulative exemption. This means that you do not have to claim the entire amount at once but you can claim any part of it when you dispose of qualifying property.

What Type of Property Qualifies for Exemption?

There are three types of property that can give rise to the capital gains exemption:

- The sale of Qualified Small Business Corporation shares;

- The sale of farming property; or

- The sale of fishing property

What are the requirements for a qualified small business corporation?

It is best to consult with your accountant or lawyer to determine whether or not your business is qualified for exemption. However, basic conditions that need to be met include:

- The sale of your business must be a share sale

- No one but the owner or related person must have owned the shares for two years prior to the sale.

- 50% or more of the business’s assets must have been used in an active business in Canada for 2 years prior to the sale.

- At the time of sale, 90% of the value of the business's assets must be used to generate active business income or the assets must be shares or debt in other qualifying small business corporations.

3. Income Splitting & Deferring Taxes

Especially beneficial for family-owned businesses, holding companies offer the ability to split income amongst adult family member shareholders and provide flexibility in the timing of that income payment.

As mentioned earlier, an active corporation can extract earnings to the holding company by the way of dividends. Family member shareholders who may be in the lower income brackets can take advantage of their lower marginal tax rates on those dividends.

Another advantage of a holding company is that it allows shareholders control of when income is actually earned and ultimately, defer when taxes are owed.

4. Estate Planning Tool

A holding company can aid with the transition of your business assets to future successors. Although not suitable for all business owners, there are various strategies that may be considered as part of a business succession plan.

One of these strategies is an estate freeze. With the help of a holding company, an estate freeze allows the business owner to limit the value of the business's assets, transfer all future growth of the business to his/her successor while maintaining control of the business.

Conclusion

Forming a holding company can be a complex and complicated matter which requires input from both accounting and legal professionals. If you have more questions relating to holding companies or other legal matters, don't hesitate to give us a call at (778) 565-4700 or fill out our contact form to schedule a free consultation.

The preceding content is for informational purposes only and does not constitute legal or professional advice. To obtain such advice, please contact our offices directly.

Last updated on June 29th, 2022 at 12:28 pm